alameda county property tax rate

There are several ways to pay your property taxes in Alameda County. 1106 Madison St Oakland California 94607.

Alameda County Ca Property Tax Calculator Smartasset

Your areas property tax levy can be found on your local tax assessor or municipality website and its typically represented as a percentagelike 4.

. To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address. Annual Secured Property Tax Bill The annual bill which includes the General Tax Levy Voted Indebtedness and Direct Assessments that the Department of Treasurer and Tax Collector mails each fiscal tax year to all Los Angeles County property owners by November 1 due in two installments. Appeal your property tax bill penalty fees and validity of assessment date.

Alameda County has one of the highest median property taxes in the United States and is ranked 68th of the 3143 counties in order of median property taxes. The rental income potential is also higher than. Check out popular questions and answers regarding property taxes.

However if you do not have that information please provide your name the type of bill you receive eg boat business property the property address and the billing address. The median property tax in Alameda County California is 3993 per year for a home worth the median value of 590900. Please provide the year and bill number if available.

The median property tax in Indiana is 105100 per year for a home worth the median value of 12310000. There are typically multiple rates in a given area because your state county local schools and emergency. Property Tax Bill Questions Answers.

Estimate your supplemental tax with Placer County. Alameda County collects on average 068 of a propertys assessed fair market value as property tax. Alameda County ˌ æ l ə ˈ m iː d ə AL-ə-MEE-də is located in the state of California in the United StatesAs of the 2020 census the population was 1682353 making it the 7th-most populous county in the state and 21st most populous nationally.

Get copies of current and prior year. Please note that we can only estimate your property tax based on median property taxes in your area. Indiana has one of the lowest median property tax rates in the United States with only ten states collecting a lower median property tax than Indiana.

Adjusted Annual Secured Property Tax Bill. State and local sales taxes here are also lower than the national average and there are no estate or inheritance taxes either. Substitute Unsecured Tax Bills.

Counties in Indiana collect an average of 085 of a propertys assesed fair market value as property tax per year. Find different option for paying your property taxes. So assuming the assessed property value in a specific area is 100 million and the budgetary needs are 10 million for the city 4 million for the county and 5 million for the school district the citys mill rate will be 01 10 million100 million the countys rate will be 004 and the school districts 005 resulting in a total mill rate of 019 or 190 mills for a 19 tax rate.

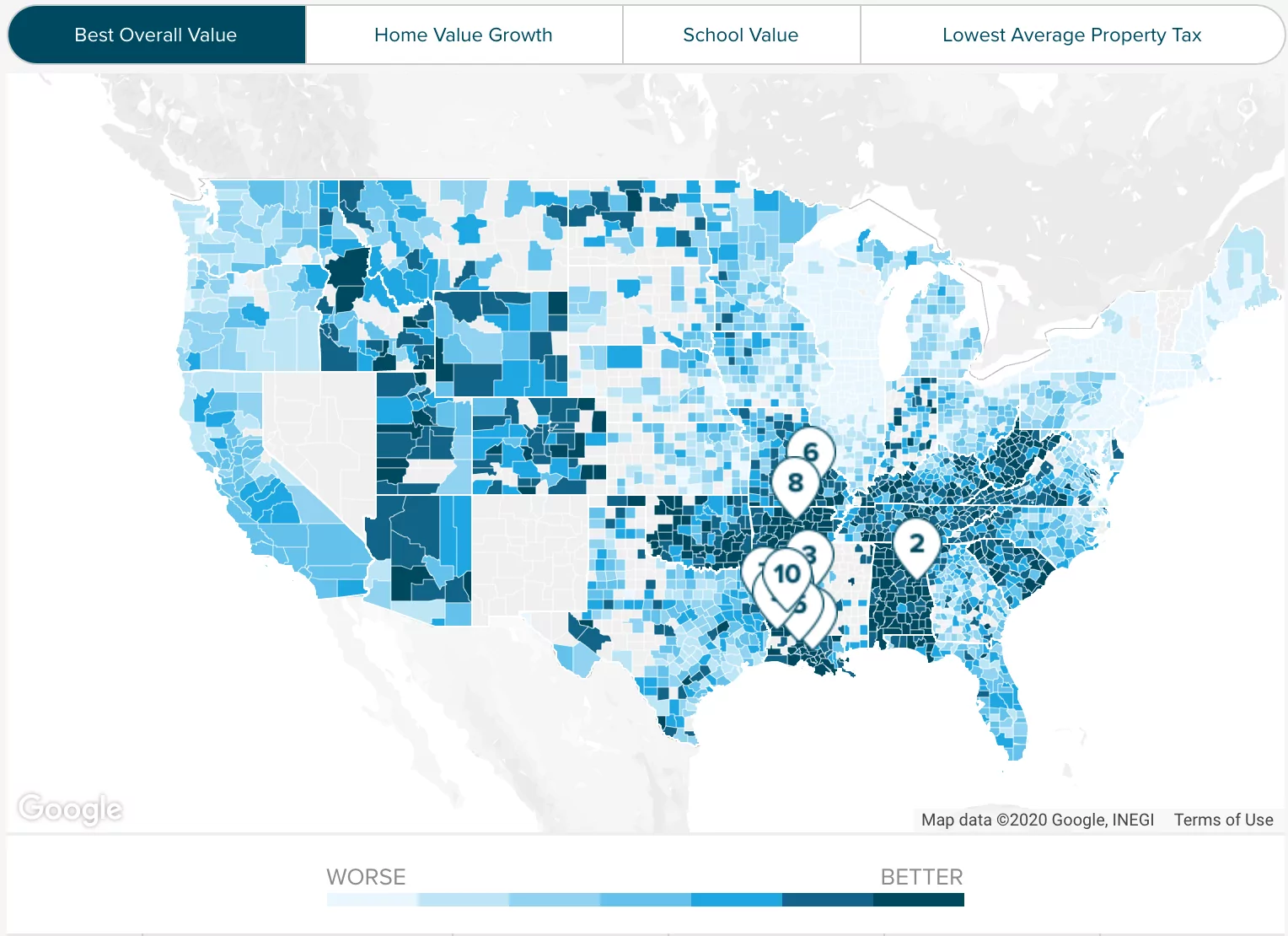

When combined this helped make the Wyoming housing market more affordable than many other areas in the country. Residents of Alameda County where the median home value is 707800 pay an average effective property tax rate of 078 for a median tax bill of 5539. The average property tax rate in Wyoming is well below the US average in 2020.

Mon-Fri 830 to 430 avoid 1200 to 200 Phone. Alameda County is in the San Francisco Bay Area occupying much of the East Bay region. The county seat is Oakland.

If you want a substitute tax bill please call the Unsecured Property Tax Section at 213 893-7935.

Alameda County Ca Property Tax Search And Records Propertyshark

Alameda County Ca Property Tax Calculator Smartasset

Recycling And Garbage Services In Your City Stopwaste Home Work School Household Hazardous Waste Garbage Service Alameda County

Alameda County Ca Property Tax Search And Records Propertyshark

Transfer Tax Alameda County California Who Pays What

Alameda County Ca Property Tax Search And Records Propertyshark